The Canada Revenue Agency allows companies to claim deductions on qualifying art rentals and purchases as capital costs

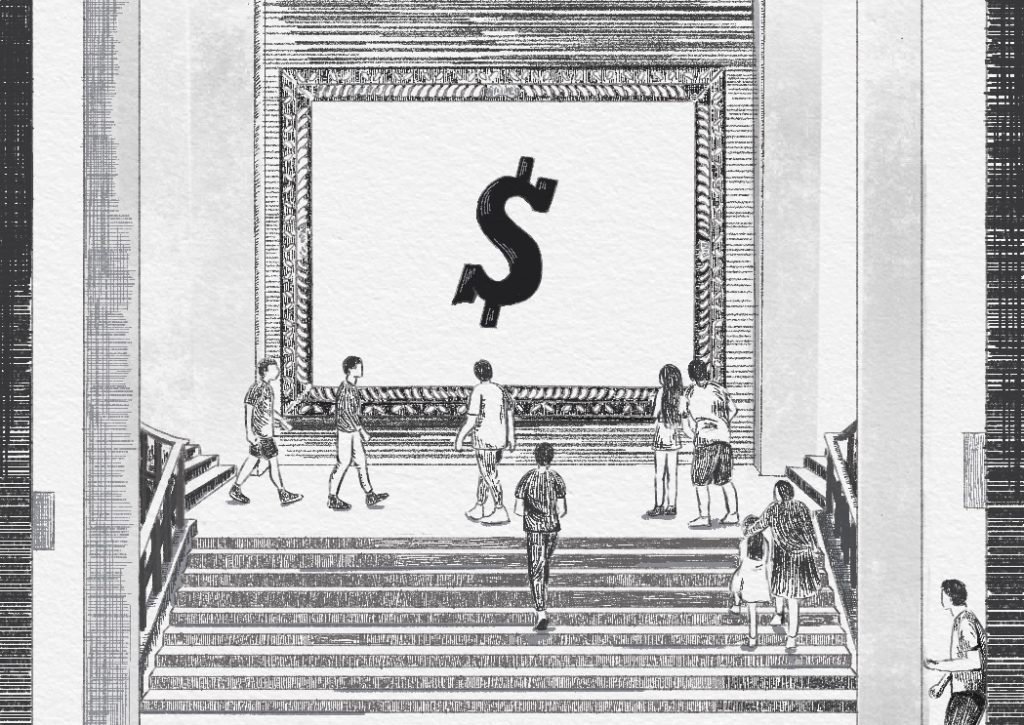

Words by Robin Poon, Illustration by Selina You

While art is a creative pursuit first, Partial helps Canadian artists to turn their passions into a sustainable living. However, art lovers who own businesses can also enjoy financial benefits from the art that they rent or own.

Under the federal Income Tax Act, companies are able to deduct the cost of acquiring artwork such as paintings, drawings, prints, sculptures, and so on as part of their capital cost allowance (CCA).

To qualify for a deduction, the artwork must meet these criteria:

- Cost more than $200;

- Is an original;

- Was created by an artist who is Canadian (or more technically, was Canadian at the time of the work’s creation);

- Have been created less than 100 years ago;

- Is not being held for resale or otherwise counted as inventory, and;

- Is acquired to gain or produce income from a third party (basically meaning the artwork is meant for a business purpose rather than personal use, such as decorating an office space, including a home office).

Pieces of art as described above are considered a Class 8 asset (alongside items like furniture and telephone equipment) within the CCA by the Canada Revenue Agency. Thus, the cost of buying or renting them are generally eligible for a 20 per cent deduction (to account for the art’s depreciation) at the federal level over a five-year period. The majority of the works available on Partial qualify.

This strategy could be useful to companies trying to offset upcoming taxes on profits at year’s end. That said, if sold, the Canada Revenue Agency (CRA) can then “recapture” (or collect) the previously deferred taxes up to the original cost paid for an artwork. Any amount received above this would be counted as capital gains in the year of sale.

Buyers with a GST or HST number can also recover taxes paid on qualifying art by claiming input tax credits on them.

There are of course many more complexities to the deductions (for example, a group of related artworks are treated as a single entity upon sale when calculating capital gains, even if only some of the artworks in the set are sold) than we can cover here, so make sure to ask your accountant for specific advice if you are considering an art rental or purchase for business purposes.

Partial’s new art consultancy can help you find the perfect piece for your office space – and save money.

Learn more about art consultations for your office.

Robin Poon is editor of Investor’s Digest of Canada, a twice-monthly publication covering the Canadian stock markets and other types of investments. He works and writes out of Toronto, Ontario.